Presently there is no provision for deduction of tax at source (TDS) on payment of salary, remuneration, interest, bonus, or commission to partners by the partnership firm. In ACIT v. Dhar Construction Company [2023] 146 taxmann.com 81 (Gauhati – Trib.), it was held that :

What is Salary?

- Any payment of salary, bonus, commission or remuneration, is collectively termed as “remuneration” as per section 40(b)(i) of the Act. As such, no TDS is deductible u/s 194H from commission payable to partners. The contention of the AO that the provisions of section 194H of the Act, which is otherwise applicable in case any commission or brokerage (not being insurance commission referred to in section 194D of the Act) is paid, is also applicable in cases where a partnership firm pays commission to its partners, authorized by the partnership deed, is incorrect.

- Explanation 2 to Section 15 of the Act specifically provides that salary, bonus, commission, remuneration etc. by whatever name called due to or received by a partner of a firm from the firm shall not be for regarded as “salary” the purposes of this Accordingly, provisions of Section 192 related to salary would also not be applicable in cases where remuneration has been paid by the partnership firm to its partners.

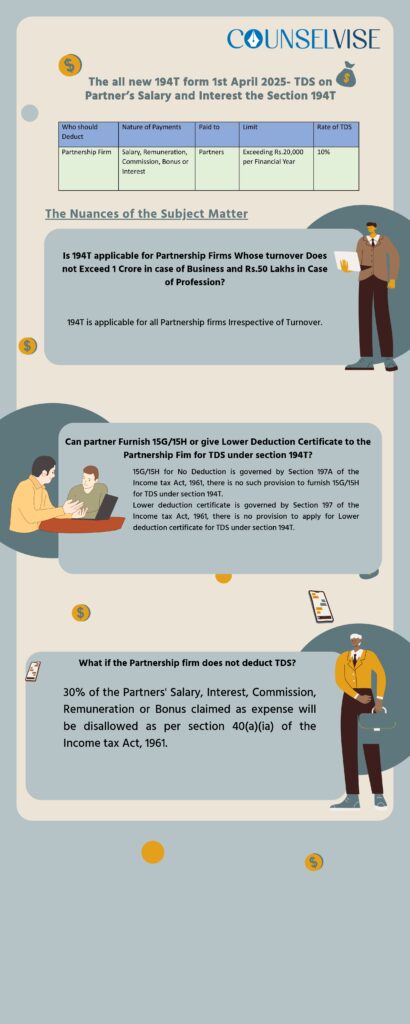

Therefore, to overcome the above decision, the Finance (No. 2) Act, 2024 has inserted into the Act a new TDS section 194T to bring payments such as salary, remuneration, commission, bonus and interest to any account (including capital account) of the partner of the firm under the purview of TDS for aggregate amounts more than ` 20,000 in the financial year. The applicable TDS rate will be 10%. The provisions of section 194T of the Act will take effect from the 1st day of April, 2025.

| Provision | Details |

| Applicability | Applies to payments made to partners of firm, including salary, bonus, commission, interest, and remuneration |

| Threshold limit | TDS is applicable only if the aggregate amount paid to partner in financial year exceeds Rs.20,000 |

| Rate of TDS | The applicable TDS rate is 10% |

Timing of TDS Deduction

Section 194T specifies that TDS should be deducted at the earlier of the following two events:

- At the Time of Credit: When the sum is credited to the partner’s account, including capital accounts.

- At the Time of Payment: When the payment is made to the partner, whether through cash, cheque, draft, or other modes.

This approach ensures timely TDS deductions, reducing the risk of tax evasion and delays in tax payments.

The ingredients of Section 194T are as follows:

- Section 194T casts an Obligation upon a firm

- Obligation is to deduct TDS on any sum paid or credited to a partner of the firm . The credit of the sum may be to any account of the partner, including his capital account.

- Such sum paid or credited should be in the nature of salary, remuneration, commission, bonus or interest.

- Such sum is paid or credited on or after 1-4-2025.

- Deduction of TDS is to be at the rate of 10% of such sum.

- Deduction of TDS is to be made at the time of credit of such sum to the account of the partner (including the capital account) or at the time of payment thereof, whichever is earlier.

- Obligation to deduct TDS as above shall not apply where such sum or, the aggregate of such sums credited or paid or likely to be credited or paid to the partner of the firm does not exceed twenty thousand rupees during the financial year.

- No power to CBDT to issue any removal of difficulties order.

Whether TDS u/s 194T applicable on an LLP?

Yes, Section 194T is applicable to firms, including partnership firms and LLPs.

As per Section 2(23)the Income Tax Act, 1961, “firm” shall have the meaning assigned to it in the Indian Partnership Act, 1932 (9 of 1932), and shall include a limited liability partnership as defined in the Limited Liability Partnership Act, 2008 (6 of 2009).

As per Section 2(23) the Income Tax Act, 1961, “partner” shall have the meaning assigned to it in the Indian Partnership Act, 1932 (9 of 1932), and shall include,—

(a) any person who, being a minor, has been admitted to the benefits of partnership; and

(b) a partner of a limited liability partnership as defined in the Limited Liability Partnership Act, 2008 (6 of 2009)

Why TDS u/s 192 not applicable on partners salary or remuneration?

As per Explanation 2 of Section 15 of Income Tax act for Salaries:

Any salary, bonus, commission or remuneration, by whatever name called, due to, or received by, a partner of a firm from the firm shall not be regarded as “salary” for the purposes of this section. Hence, no TDS liability was there on partner’s salary or remuneration u/s 192.