Residential status is one of the most critical factors in determining an individual’s tax exposure in India. For decades, Section 6 of the Income-tax Act, 1961 laid down clear and well-understood rules to decide whether a person qualifies as a Resident or Non-Resident.

With the proposed Income-tax Bill, 2025, while the overall framework remains intact, a subtle but important tightening has been introduced; one that individuals working overseas and tax professionals must not overlook.

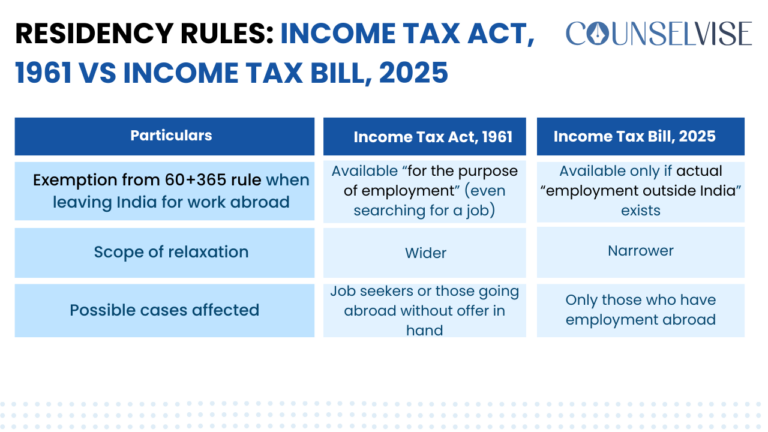

What the law said earlier (Income-tax Act, 1961)-

Under Income Tax Act, 1961 an individual was treated as a “Resident” if they:

-

- Stayed in India for 182 days or more in a year, or

- Stayed for 60 days in the year and 365 days in the preceding four years

However, there was a significant relief. If an Indian citizen left India for the purpose of employment abroad, Explanation 1(b) under Section 6 of the Act ( i.e. the 60+365 day condition) did not apply.

In practice, this phrase was interpreted widely; covering even those who went abroad to explore or search for job opportunities.

What changes under the Income-tax Bill, 2025-

The proposed Bill narrows this relief.

The exemption from the 60+365 day rule now applies only when:

-

- A person leaves India as a crew member of an Indian ship, or

- Leaves India for actual employment outside India

The earlier, broader phrase “for the purpose of employment” has been consciously replaced. This linguistic shift materially raises the bar.

Why this matters in real life

-

- Earlier, individuals going abroad without a confirmed job could still claim Non-Resident status.

- Going forward, mere job hunting abroad may not suffice.

- Without proof of overseas employment, individuals may end up being classified as Residents, triggering taxation of global income in India, and Increased reporting and compliance obligations.

Closing thoughts

What appears to be a minor drafting change is, in reality, a policy-driven tightening of residency norms. The objective is to prevent the misuse of Non-Resident status based solely on temporary overseas movement without substantive employment.

Professionals, NRIs, and consultants planning to move abroad for career opportunities should carefully evaluate this change and plan accordingly.