The year 2019 has been a very significant one to the taxation regime as the government has introduced various revolutionary changes in the laws and rules and regulations.

The contribution of the judiciary including the Supreme Court and various High Courts and Tribunals has always been significant. Some of the income tax latest case laws and latest income tax judgements in India delivered by the Indian judiciary of Tribunal in this year 2019 are compiled and curated by our team as follows.

Latest Income Tax Judgements

- Sh. Kuldeep singh v. Income tax officer [Amritsar-Trib]

Important Tags – Gift, Best Judgement assessment u/s.144, Reason to believe, 143(3), 142(1), 147, 148

During the course of assessment proceedings, the AO

observed that the assessee had made cash deposit in the undisclosed bank

account. The assessee submitted that the cash deposit was from the gift

received by him from his father. He further submitted that said amount

represents the sale consideration derived by his father from sale of certain

agricultural land and from his savings and also submitted sale deeds and record

of land which proves his father was agriculturist and had sufficient

agriculture land. However, the AO rejected the contention of the assessee and

made addition under section 68.

Aggrieved by the same, assessee filed appeal before

the Ld. CIT(A). It upheld the order of AO and confirmed the reopening of the

assessment.

On further appeal, ITAT held that the AO failed to bring on record any cogent evidence to prove that sale deed executed by assessee`s father was wrong and the record of land was false or untrue. And since the assessee explained the source of bank deposits therefore income has not escaped assessment within the meaning of section 147 of the Act. Hence, the ITAT quashed the reassessment proceedings initiated by assessing officer.

2. M/s Hirsch Bracelet India Private Limited v. Assistant Commissioner of Income Tax [Bangalore-Trib.]

Important Tags – Capital Asset, Depreciation, Opportunity of being heard, Bad and doubtful debts, Revised Return, Unabsorbed depreciation, TDS, 143(3), 37

The

issue revolves around three major concerns, first whether all the expenditures

incurred after transfer of leasehold rights are to be allowed as deduction. The

Tribunal relying on the judgement of High Court of Karnataka in case of

Lawrence D’souza held that even though the business had come to a halt but

being a company all the expenditures incurred were necessary to maintain its

legal status till the assets are liquidated and hence allowed as deduction.

The

second issue deals with whether a claim that the capital gain earned on sale of

land and building is to be bifurcated separately as wrongly claimed by assessee

in his return of income is to be allowed. The Tribunal held that CIT(A) has the

power to examine the claim and remand the claim to AO if required, hence it was

directed to AO to examine the claim placed before CIT(A).

The third issue pertains to whether the profit on transfer of depreciable assets can be set off against unabsorbed depreciation. The Tribunal held that as the transfer led to short term capital gain, is in nature of business income and hence can be set off against the unabsorbed depreciation. [Partly allowed in favour of assessee]

3. M/s. Mahesh Software Systems Pvt. Ltd. v. Assistant Commissioner of Income tax [Pune- Trib.]

Important Tags – Business Income, TDS

In terms of Rule 37BA(3)(i) benefit of TDS is to be given for assessment year for which corresponding income is assessable, therefore, where assessee raised invoice on ‘A’ in March 2011, benefit of TDS had to be allowed in assessment year 2011-12 even though tax on invoice amount was deposited by ‘A’ in April 2011

4. AIG Offshore Systems Services Inc. V. Asst DIT [Mumbai – Trib.]

Important Tags – Capital Asset, Business Expenditure, Corroborative Evidence

Where assessee being a foreign company sold shares in its Indian subsidiary, for computing long term capital gain and it claimed deduction of the legal/professional fees of lawyers/ accounting firms, keeping in view that such services received by the assessee were in relation to advise on sale of entire shareholding of Indian subsidiary and included preparation of share sale/purchase agreement etc., thus it could be concluded that such expenditure was in relation to transfer of shares of Indian subsidiary and the asseesee’s claim for deduction was valid.

5. ITO, Thiruvalla v. M/s.Toms Enterprises [Cochin – Trib.]

Important Tags – Gross Profit estimation, Block assessment, Onus to prove, Retraction, 131, 133A

Where during the course of survey u/s 131, the assessee being a company, Assessing Officer cannot make additions to income of assessee only on the basis of sworn statement of its managing director and without support of any corroborative evidence.

6. The Malad Sahakari Bank Ltd v. DCIT [Mumbai – Trib.]

Important Tags – Business Income, General deductions, Depreciation, Bad and doubtful debts, Provision of Bad debts, 37, 37(1), 36(1)(viia)

“Assessee being co-operative bank is eligible for deduction of provision for doubtful debt and loss assets u/s 36(1)(viia) to extent of 7.5 percent of business income. Depreciation on securities held as ‘available for sale’ was allowed to assessee which was computed and claimed consistently every year by assessee in its profit and loss account. Assessee was entitled to deduction u/s 36(1)(vii), where he has admittedly written off bad debts in its books of account from individual ledgers of borrowers/defaulters during relevant previous year.”

7. ETT Ltd (formerly known as Indian Express Multimedia Ltd) v. CIT [Delhi- Trib]

Important Tags – Related party transaction, Transfer Pricing, Search and seizure, International transaction, Difference of opinion, Rule 8D, Earning of tax free income, Valuation report, 92C, 92B, 14A, 80IA, 263, 115JB, 54, 69, Audit Objection

Disallowance u/s 14A is not automatic whenever there is any kind of exempt income, it has to be viewed with regard to the nature of expenses debited and whether any expenditure can be calculated. The Commissioner cannot rely on the judgement of the Assessing Officer without carrying out his own enquiry and without pointing out any legal or factual infirmity.”

8. M/s. Pratham Investments v. Dy. CIT [Ahmedabad – Trib.]

Important Tags – Business Income, Speculation loss, Difference of opinion, reason to believe, change of opinion, futures and options, 143(3), 28, 147

The reassessment proceedings could not be initiated by the Assessing officer on the ground that loss arising from changing from one plan of mutual funds to another was of capital nature when he himself had treated profits from sale of such mutual funds as business income.

9. Manoj Kumar Jaiswal v. Asst. CIT CPC TDS [Bangalore – Trib.]

Important Tags – Principle of natural justice, TDS, 10, 154, 139

No power is conferred under any provisions of Act to declare return of TDS filed under section 200(3) as non-est and, thus, treating payee as assessee-in-default and exposing him to other consequences as assessee-in-default.

10. Varun Seth v. ACIT [Delhi – Trib.]

Important Tags – Capital asset, 54F, 54, 10, 139

Where assessee invested the sales consideration from selling residential property, in a plot for purpose of construction of residential house, claim for such exemption u/s 54 could not be denied, only because the assessee could not obtain possession of plot due to developer’s failure to offer possession within a period of three years.

11. The Bank of Tokyo Mistubishi UFJ Ltd. v. DCIT (International Taxation) [Delhi Trib.]

Important Tags – 234D, Depreciation, 144C, Transfer pricing

Charging of interest u/s. 234D is not justified when refund due to assessee has been adjusted to the outstanding demand.

12. N Ramaswamy v. ITO [Chennai – Trib.]

Important Tags – Capital asset, Capital gains,54F, 54, 263, 139

Assessee

entered into an agreement for perpetual lease for unlimited period and claimed

exemption under section 54F.

Assessing

Officer (AO) allowed the exemption claimed by the assessee. However, the

Principal Commissioner (PCIT) observed that the assessee had acquired the

property by way of perpetual lease deed agreement and therefore, it cannot be

considered as absolute purchase of the property for claiming exemption under

Section 54F of the Act. Thus, he revised the order of AO and disallowed the

exemption claimed by assessee.

On

appeal before the Tribunal, it held that a bare reading of section 2(47) shows

that the agreement or arrangement which has effect of transferring or enabling

the enjoyment of immovable property, has to be considered as transfer.

Furthermore, section 269UA(2) of the Act clearly says that any lease for a term

of more than 12 years including the possession of property has to be construed

as transfer.Since the assessee had acquired the residential house by means of

perpetual lease for more than 12 years, it had to be treated as acquisition of

property within the meaning of section 54F.

Therefore, assessee was entitled to exemption under section 54F and allowed the appeal of the assessee.

13. Emmsons International Ltd. v. ACIT [Delhi- Trib.]

Important Tags – Commercial expediency, Capital expenditure, 37(1), 12

Expenditure incurred on foreign travel of spouse and children of director of assessee company when they accompany him is not a business expenditure and therefore cannot be allowed as deduction u/s 37(1). Foreign currency loss on forward contract can be allowed as business loss when assessee is engaged in the business of international commodity trading.

14. ACIT v. Shri Akshay Sobti [Delhi-Trib.]

Important Tags – Capital asset, question of law, Cost of acquisition, 54F, 54, TDS, 205.

During

the year under consideration, the assessee sold a residential house property

and invested sale consideration for booking a semi-finished residential flat

from a builder and claimed exemption under section 54. The AO disallowed the

exemption on the grounds that assessee had purchased new property beyond period

of one year prior to date of transfer prescribed under section 54.

The Delhi ITAT held that assessee had booked a semi-finished flat with the builder and as per agreement, he had to make payment in instalments and the builder was to construct the unfinished bare shell of flat for finishing by the buyers on their own to make it liveable. It had to be considered as a case of purchase of property for construction of new residential house and not purchase of a flat. Therefore, he had a time window of three years available to him to construct a house property, thus, the exemption under Section 54 cannot be denied.

15. Shree Laxmi Estate P. Ltd v. ITO [Mumbai- Trib.]

Important Tags – Sale consideration of property below Jantri value, Business income, Depreciation, Additional evidence, 50C, 32, 68, 43CA

During

the year under consideration, the assessee, a property developer adopted

‘Project Completion Method’ for a project which was still under construction

during the year. During the course of assessment proceedings, AO noticed that

there was total difference of Rs. 3,41,41,270/- between the agreement value of

the flats booked and the Stamp duty Value of those properties. Addition of Rs.

3,41,41,270/- was made u/s 43CA of the Act. CIT(A) also affirmed the addition

made by the AO.

Tribunal

held that Section 43CA can be applied only when there is transfer of land or

building or both whereas what assessee had transferred pursuant to registration

of the said agreement was only the rights in the flat/ office (which is under

construction) and not the property per se. Hence it could be safely concluded

that there was no transfer of any land or building or both by the assessee in

favour of the flat buyers pursuant to registration of the agreement during AY

2014-15. Reliance was placed on the decision of:

- Hon’ble Ahmedabad

ITAT in the case of ITO v. Yasin Moosa Godil [ITA No. 2519/Ahd/2009 dated

13/04/2012]

- Hon’ble Jaipur ITAT in the case of Mrs Rekha

Agarwal vs ITO [(2017) 79 taxmann.com 290 (Jaipur Trib.) dated 17.2.2017]

Accordingly, the impugned addition of Rs.3,41,41,270/- made u/s. 43CA was directed to be deleted.

16. ACIT v. Shri Harish Narinder Salve [Delhi-Trib.]

Important Tags – Gift, Business Expenditure, Commercial expediency, revenue expenditure, capital expenditure.

During

the year under consideration, the assessee (being advocate) entered into a

scholarship agreement with the Exeter College, the University of Oxford and

paid scholarship to two students. As per the agreement, he committed to provide

annual funding for scholarship of graduate student at Oxford University for top

Indian student on annual basis. He claimed that the above expenditure was

deductible under section 37. However, the AO disallowed the deduction claimed

by the assessee on the ground that the scholarship paid by the assessee was a

gift to the college.

Delhi Tribunal held that assessee had set-up a scholarship for creating his visibility in international arena and his social standing. This had increased lot of value in his CV and the Singapore government had appointed him on certain Committees of repute. The assessee had also shown that one of the students to whom scholarship had been granted helped him in a famous Vodafone case. Therefore, the assessee had incurred the above expenditure wholly and exclusively for the purpose of his business.

17. Manoj Sharma v. ITO [Delhi – Trib.]

Important Tags – Bogus purchase, Accommodation entries, reason to believe, principle of natural justice, 69C, 147, 148

No addition on account of unexplained purchases could be made, where correct entries are found in assessee’s trading account including quantitative tally of purchases, opening stock, sales and closing stock.

18. M/s. J.C. Bhalla & Co. v. Addl. CIT [Delhi- Trib.]

Important Tags – Capital receipt, cost of acquisition, Source of fund, retrospective amendment, 40(b), 54, 28, 11, Business Income

“Assessee

being a Chartered Accountancy partnership firm, would be eligible to exemption

u/s 54EC, where it invested capital gains earned from sale of its client

relationships and goodwill pertaining to its business of internal audit and

risk consultancy(IARC) practice in specified bonds.

Where payment of bonus made to partners was specifically mentioned in a supplementary partnership deed and also specified exact amount of bonus payable, such payment could not be disallowed u/s 40(b).”

19. Dy.CIT v. Shri Arvind N. Nopany [Ahmedabad- Trib.]

Important Tags – Gift, Document seized, capital receipt, 143(3), 142(1), 56(2), 132

In

this case the assessee had received gift from his brother in law out of natural

love and affection. Assessee’s brother in law was the 40th richest man

according to the Forbes and had high net worth. Assessing Officer doubted the

donor’s relation with assessee and required the assessee to prove the identity,

genuineness and creditworthiness of the donor and also required the assessee to

produce the donor. Assessee submitted donor’s PAN, account statement, bank

statement in order to prove the same however it was not possible to produce the

donor in short notice period as the donor resided in different city.

Tribunal did not find any inference with the judgement of CIT(a) wherein it was held that as assessee has proved the identity, genuineness and credit worthiness of donor and as relation with brother in law fits in the definition of relative given in the proviso to Section 56 therefore the gift received qualifies for the exemption under section 56. Hence, Revenue’s appeal is dismissed.

20. KKB Projects Pvt. Ltd v. Pr. CIT [Surat- Trib.]

Important Tags – Revision of Order, set aside, Transfer Pricing, revenue expenditure, 40A(2)(b).

During the year

under consideration the assessee was engaged in the business as a government

contractor for construction works. The scrutiny assessment was finalized

u/s.143(3). Subsequently, the Pr.CIT observed that there were various payments

made by assessee to persons covered u/s.40A(2)(b)

of the Act

in the form

of director remuneration, rent

expenses and purchase

payments and was of the opinion that no proper verification has been

made by the AO in respect of these payments. Therefore, Pr.CIT made revision to

the order u/s.263 of the Act.

Tribunal held

that the assesse has filed the audited reports containing all the details

regarding related parties u/s.40A(2)(b) along with Name, PAN, Relations, nature of transactions and payments made. Even otherwise, the assessee has also duly

furnished the report from expert in Form 3CEB as required by Law, wherein all

the details of payment made related to

party were mentioned i.e. name of persons

with whom specifically domestic transactions as entered into, description of transaction along with quantitative

details if any. Total amounts paid or payable in the transaction as per the

books and as computed by the assessee having regard to arm’s length price. The

method used for determining the arm’s length price which also goes to show that

there is nothing on the record to suggest that assessee had made any excessive

payments to the related parties which has caused loss to the Revenue.

Thus, the order passed by the AO is neither erroneous nor prejudicial to the interest of the Revenue. Merely just because the view taken by the AO was not found acceptable does not mean that the AO has failed to make requisite enquiries. Thus, the view taken by the AO was plausible view, which cannot be disturbed by the Ld. Pr.CIT. Therefore, the Ld. Pr.CIT was not correct in exercise the jurisdiction under section 263 of the Act. In view of these facts and circumstances, we quash the proceedings initiated in the impugned order passed under section 263 of the Act and allow the appeal of the assessee.

21. M/s. Vijay H. Lilawala v. The Income Tax Officer [Surat-Trib.]

Important Tags – Reopening of assessment, Unexplained cash credit, Peak credit.

Where the assessee explains that the cash deposits in bank represents business of assessee however no details of such business are furnished by the assessee, the entire transaction appearing the bank account cannot be added instead only the profit embedded therein is to be added. Here in the case, the profits declared by the assessee were more than the peak credit in bank and therefore addition made was deleted. [Referred case: CIT vs. Pradeep Shantilal Patel (42 taxmann.com 2)]

22. M/s Gopinath Gems v. The Income Tax Officer [Surat-Trib]

Important Tags – Bogus purchase, application of stay, reasonable cause.

Where AO has made addition of alleged bogus purchases solely on the basis of extracts of statement by third parties and has not provided the statement as well as an opportunity of cross examination of the same when requested by the assessee during the assessment proceedings, held to be gross violation of Principle of Natural Justice. Held that addition is to be deleted relying on the decision of Hon’ble SC in the case of Andaman Timber Industries vs. Commissioner of Central Excise[[2015] 281 CTR 241].

23. Nilay Kirtibhai Tailor v. Income Tax Officer [Surat- Trib.]

Important Tags – Unexplained cash credit, Period of limitation, reassessment proceedings, Block assessment, Business income.

Where sub-section (2) of section 150 makes it clear that re-assessment permission under section 150(1) of the Act would not be available to the Department, when the period of limitation for such assessment or re-assessment has expired at the time when order which was subject to the appeal was passed. ie the assessment order in this case and thus the direction u/s 150(1) is bad-in-law

24. Ashok G. Chauhan v. ACIT [Mumbai-Trib.]

Important Tags – Capital asset, Co-owner, 54F, Surrender of tenancy right, Gift.

Where assessee’s claim for deduction u/s 54F was rejected by Assessing Officer on the ground that at time of sale of capital asset, assessee was owner of more than one residential property, in view of the fact that one residential property was jointly owned by the assessee and his wife and he could not be treated as absolute owner, deduction u/s 54F could not be denied.

25. Mohammadanif Sulatanali Pradhan v. DCIT [Ahmedabad – Trib.]

Important Tags – Capital Gains, 54, 54F, set aside

During

the year under consideration, the assessee had declared income under the head

of Capital Gains in his return after claiming the exemption u/s. 54F for the investment

made in 2 bungalows which were adjacent to each other. AO and CIT(A) observed

that after the amendment made in section 54F; the expression earlier used as “a

residential house” was substituted with “one residential house”. This

amendment was effective from Assessment Year 2015-16 i.e. the year under

consideration. Accordingly, it was contended by the revenue that assessee

cannot claim exemption u/s. 54F for investment made in 2 bungalows. Assessee

contended that as both the bungalows were in the same society, adjacent to each

other and hence can be considered as one unit for the residential purposes.

Accordingly exemption u/s. 54F for investment made in both of the bungalows

should be allowed.

Tribunal

decided the matter in favour of assessee and allowed the exemption u/s. 54F for

investment made in both the bungalows, observing the following:

i)

Section 54F does not provide definition for the area of a residential property

to be invested in.

a) So, for instance if an assessee buys only

one property, even though area of such property is huge, he is entitled to

exemption u/s. 54F.

b) Now, merely because if assessee buys two separate properties adjacent to each other; the aggregate area of which may even be lesser than that of the property described in former instance, cannot be denied exemption just for the reason that there are two different properties based on registry documents. ii) Thus, assessee cannot be deprived of the benefit u/s. 54F merely on the ground that there were two different registries of the properties when both such properties were adjacent to each other and were used as single residential unit by the assessee.

Related:

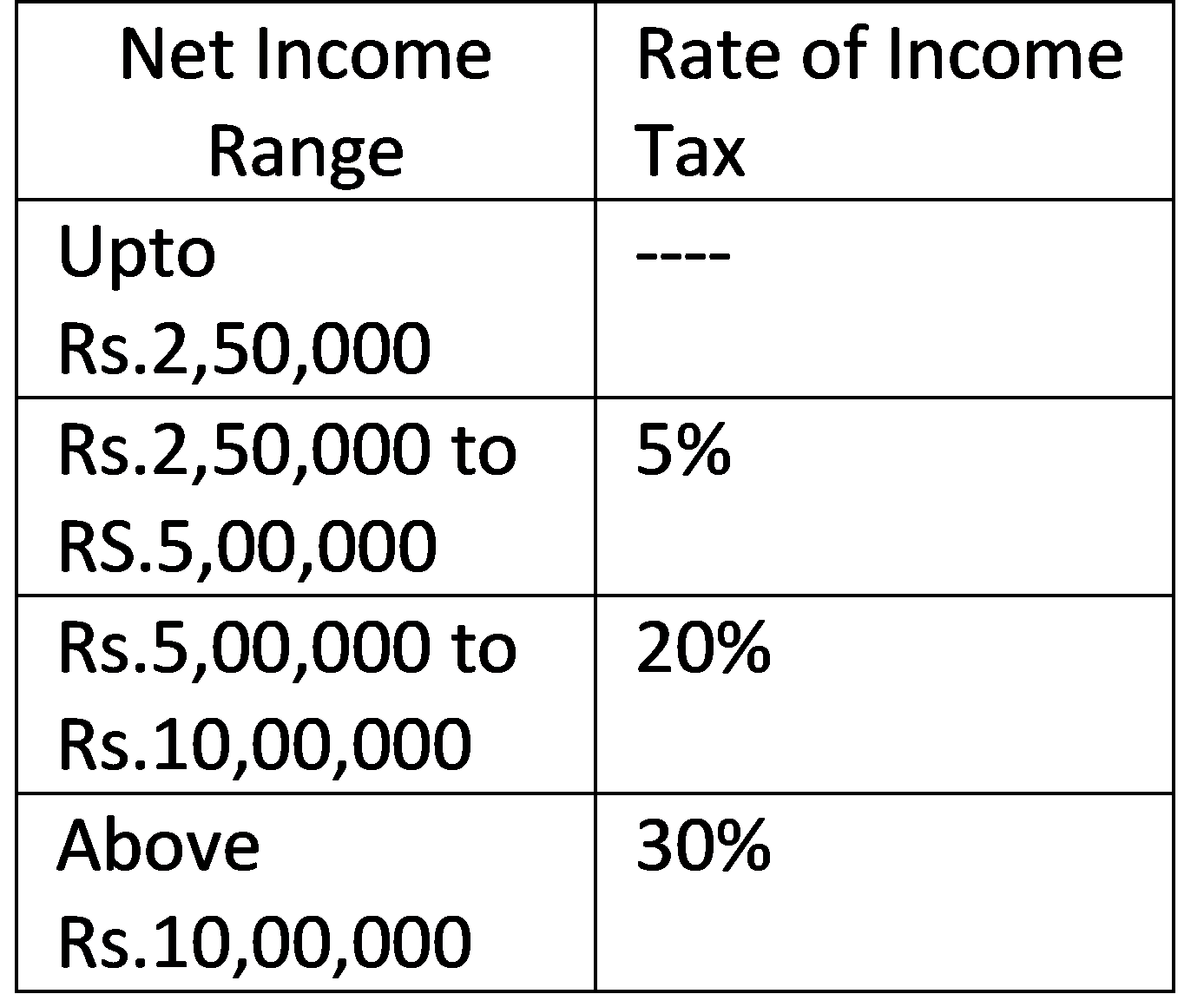

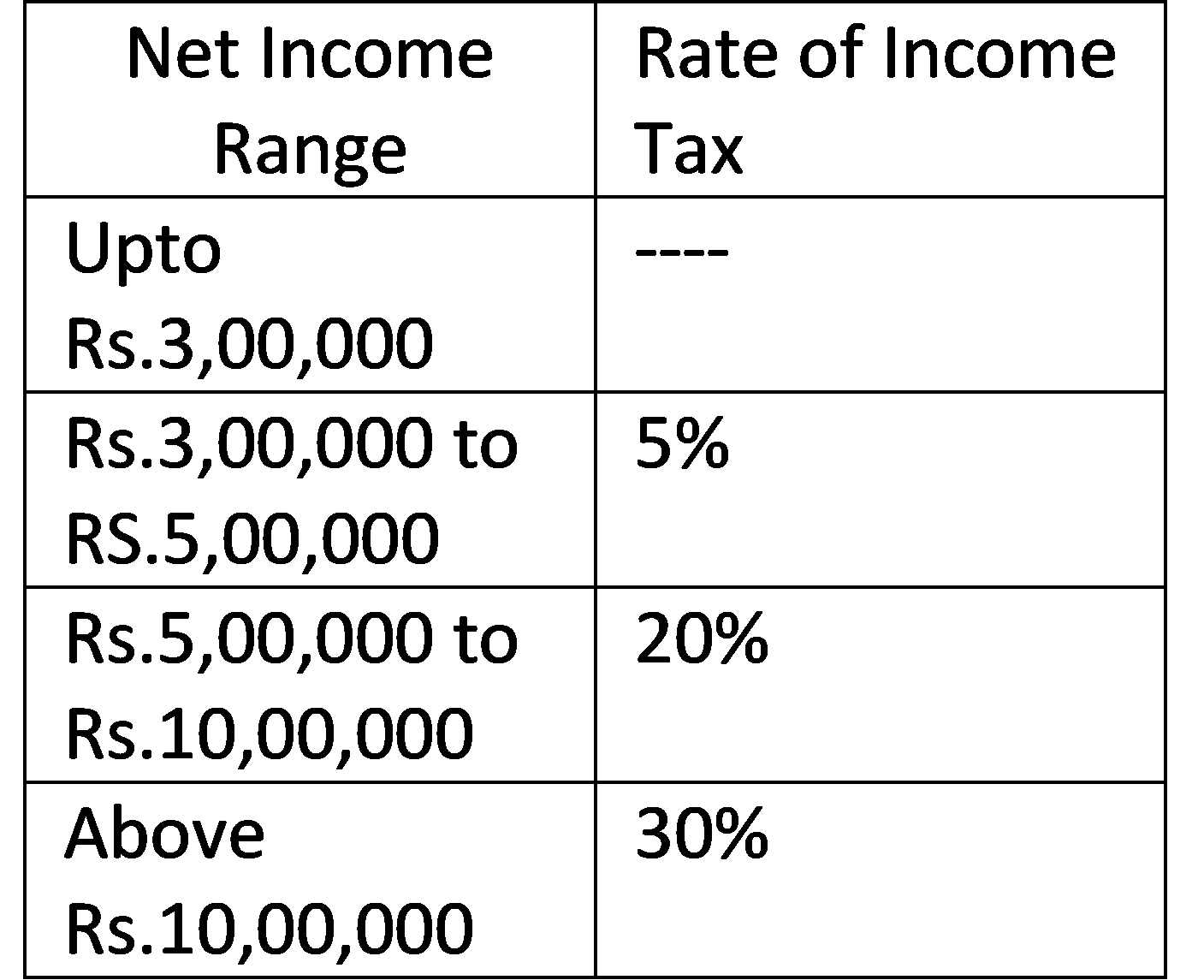

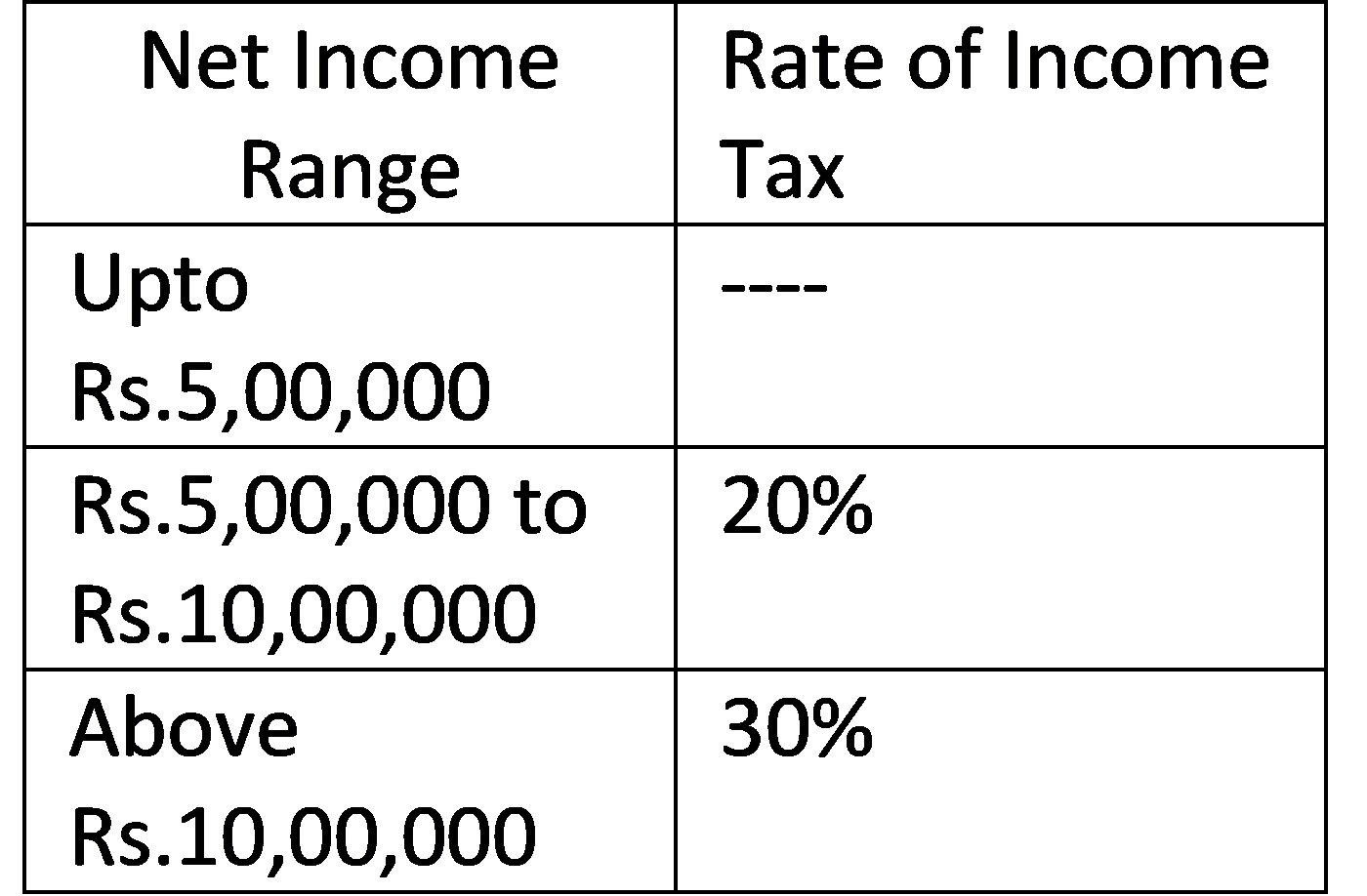

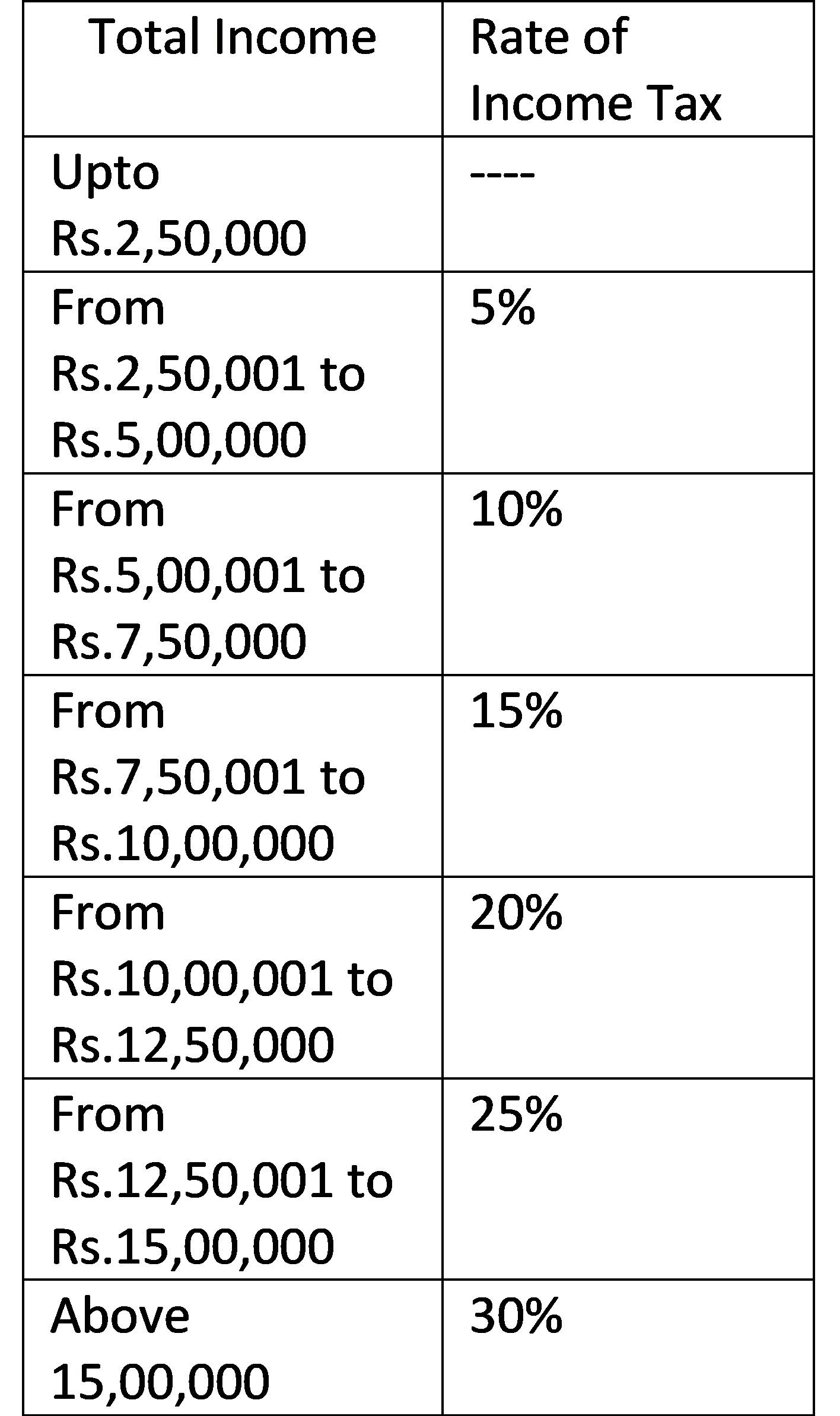

FAQs on New Income Tax Regime u/s.115BAC

8 Income Tax Judgements and Cases on Previous Demonetisation