Limited Liability Partnerships (LLPs) are now required to adhere to new compliance measures involving Significant Beneficial Owners (SBOs). A “reporting LLP” refers to a limited liability partnership required to comply with the requirements of section 90 of the Companies Act, 2013, as modified by the notification. An SBO, in relation to a reporting LLP, is an individual, who acting alone or together or through one or more persons or trusts, holds indirectly or together with any direct holdings at least ten percent of the contribution, voting rights, or distributable profit. They are the crucial players who shape the direction and decisions of the LLP.

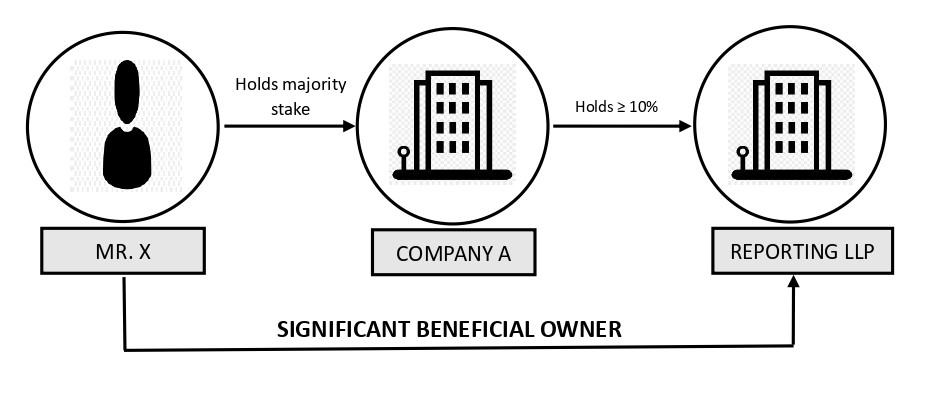

For Example: If Mr. X holds shares of more than 50% in A Limited and A Limited holds more than 10% voting rights in the reporting LLP, then Mr. X is exercising Significant Beneficial Ownership in the reporting LLP. The graphical presentation of the above example is as follows:

Compliance Steps

- The Limited Liability Partnership (LLP) must take necessary steps to identify any individuals who are significant beneficial owners in its structure.

- If an individual is identified as a significant beneficial owner, they must provide a declaration in Form No. LLP BEN-1 to the reporting LLP.

- Upon receiving the declaration from the significant beneficial owner(s), the LLP must submit the information to the Registrar in Form No. LLP BEN-2 within 30 days of receiving the declaration.

- The LLP shall maintain a register of significant beneficial owners in Form No. LLP BEN-3.

- The LLP shall issue a notice in Form No. LLP BEN-4, seeking information in accordance with sub-section (5) of section 90, as applied to LLPs by the relevant notification.

Impacts of SBO Declaration:

SBO declarations have profound impacts on promoting transparency, influencing corporate governance, enabling comprehensive disclosures, and reinforcing compliance. It helps to understand the actual individuals who control or benefit significantly from the firm, promoting better decision-making and accountability. The SBO declaration is not merely a regulatory checkbox but a legal mandate. Non-compliance could lead to penalties, reinforcing the integrity of the financial system.

The extension aligns LLPs’ SBO framework with that of companies, aiming to expose complex networks used to conceal ownership. This combats money laundering and terrorism financing. SBO declarations play a crucial role in preventing financial crimes, acting as a deterrent and enabling early intervention.

In conclusion, embracing Significant Beneficial Owner declarations isn’t just a regulatory necessity; it’s a shared commitment to fostering transparent, accountable, and responsible business environments. By navigating the seas of compliance, LLPs contribute to a stronger financial ecosystem, reinforcing integrity and trust.